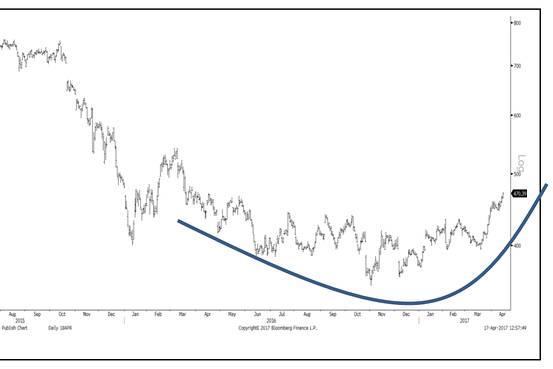

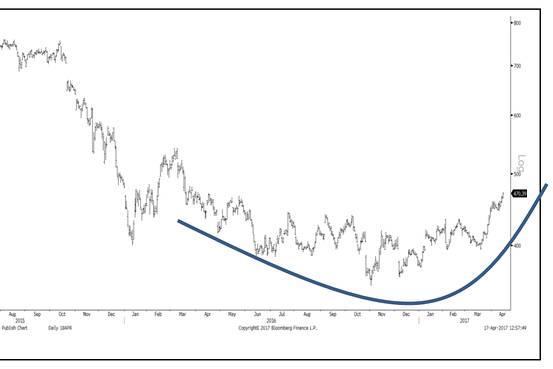

A year ago, I wrote my first article on Chipotle Mexican Grill (CMG). In it, I remarked that Chipotle Mexican Grill had been hitting fresh 52-week highs in the few trading days prior to the publication of the article. Among other bullish factors, I noted a Barron's article showing a Chipotle price chart with a nice technical setup (see below). I also noticed that the wide analysts' estimates for the then-upcoming first-quarter results which implied that some analysts might be overly bearish. As such, there was the potential for an earnings surprise. I concluded that "the upside potential continues to outweigh the downside risk due to improved circumstances".

Source: FBN's JC O'Hara

Chipotle eventually did report Q1 2017 results that beat consensus estimates on both revenue and EPS. This obviously delighted the market and the share price moved above $500 in after-hours trading. Unfortunately, Chipotle subsequently disclosed the detection of "unauthorized activity on a network that supports payment processing for purchases" that occurred at its restaurants, essentially a data breach which precipitated a reversal in the share price.

In what might seem like d茅j� vu, the share price of Chipotle has again developed the technically bullish rounding formation flagged by FBN a year ago as mentioned in the prior paragraph. Interestingly, it has also been making fresh 52-week highs in the past few days.

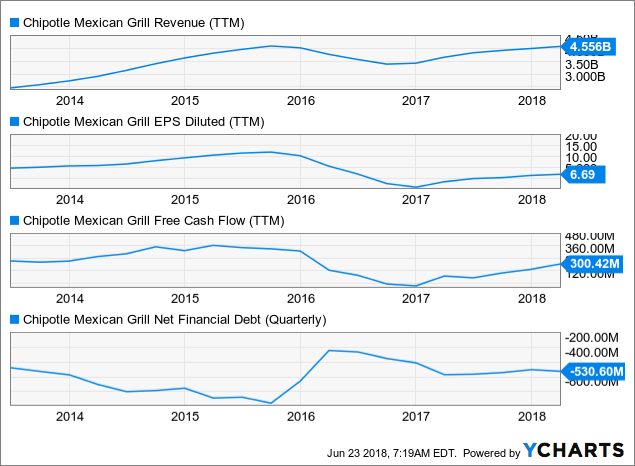

CMG data by YCharts

CMG data by YCharts

There is a saying that "those who fail to learn from history are doomed to repeat it". Hence, let's revisit how the market came to be so bearish on Chipotle as recent as February this year. Looking back in history is easy with Seeking Alpha's dedicated page for each ticker. I spotted the below "Breaking News" on February 1, 2018, which linked a fall in Chipotle on that day to a downgrade from UBS. SA News Editor Clark Schultz was very sharp and suggested that "some industry insiders" would disagree with UBS analyst Dennis Geiger in believing in "some brand deterioration" of Chipotle based on online reviews due to the fact that those could be gamed.

Source: Seeking Alpha News

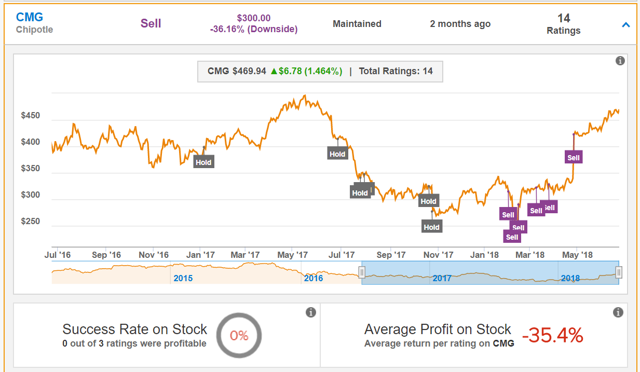

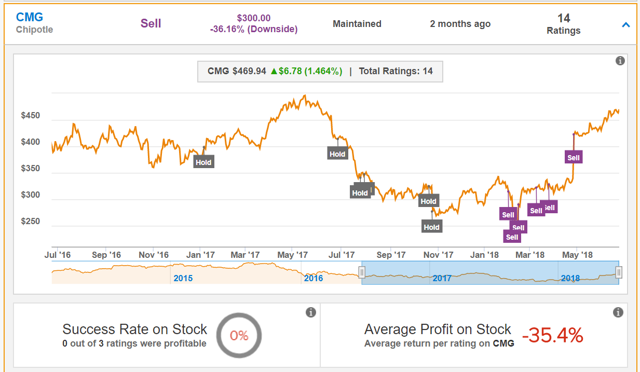

Given that Dennis is an analyst with UBS, a Swiss multinational investment bank and a prominent name in the financial circle, his downgrade certainly has significant clout. In fact, after that downgrade on February 1, Dennis went on to reiterate his Sell call on Chipotle five more times, the most recent being April 26, after a huge spike up following the announcement of its first-quarter results. To the detriment of whoever was following him on his Chipotle calls, the share price continues to head higher. Nevertheless, those who had listened to him when he recommended shareholders to "hold" in six reports throughout 2017 would now be rewarded with their patience as the share price has now indeed recovered.

Source: TipRanks

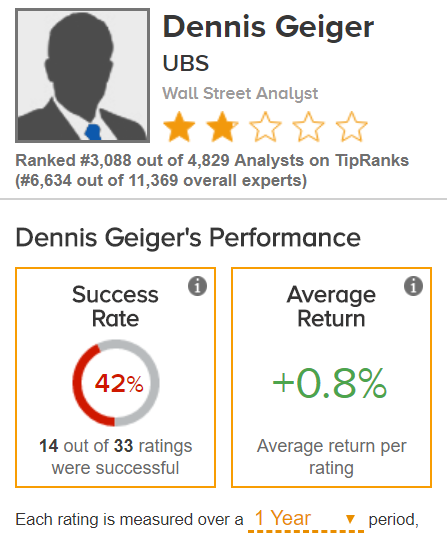

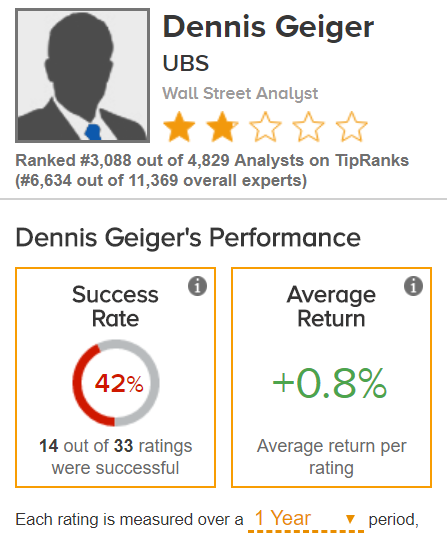

Should the market now ignore whatever Dennis says? To be fair, the price targets are usually for a full year from the date of issue. It has only been a few months since that February 1 call by Dennis. Dennis has also made the right call for about half the time (see the screenshot from TipRanks below).

Source: TipRanks

Now, before I get criticized for picking on Dennis, I would like to clarify that this is not my intention. I have stated from the beginning of this article that my initiation call on Chipotle was very off the mark as well. For transparency, I also provide the screenshot of my TipRanks profile below which shows that many of my ratings were unsuccessful as well.

Source: TipRanks

The point of going through the circumstances leading to the share price weakness is to remind me of how not to take analysts' reports at face value. Earlier, we have Dennis basing his Chipotle evaluation on some "online review trends". Below, we see another analyst relying on "Facebook check-ins" as a basis for his warning coming a week after his peer at UBS issued a downgrade. Since both the business and the share price of Chipotle have performed better than analysts' expectations, it seems to suggest that the use of such unconventional tools to determine sales trends is not effective. We should perhaps not be spooked in the future when analysts quote such data to warn on the sales trends.

Source: Seeking Alpha News

The narrative surrounding Chipotle undertook a quick reversal to the positive following the official announcement of the appointment of then-CEO of Taco Bell as the incoming CEO of Chipotle. The share price jumped double-digit percentage as the market cheered the end of the uncertainty surrounding the CEO office. Chipotle never looked back thereafter. The prevailing share price is now well above its consensus price target, creating the largest premium in the past five years.

CMG data by YCharts

CMG data by YCharts

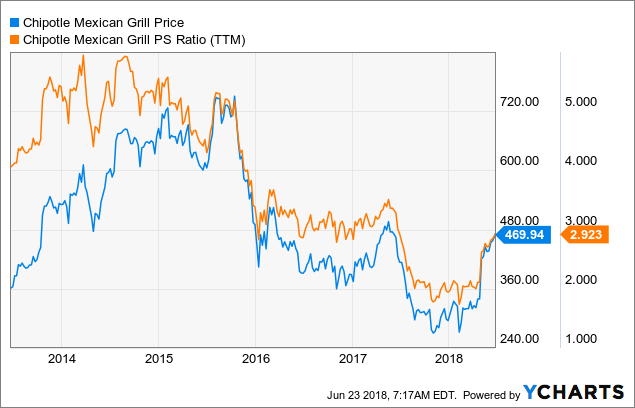

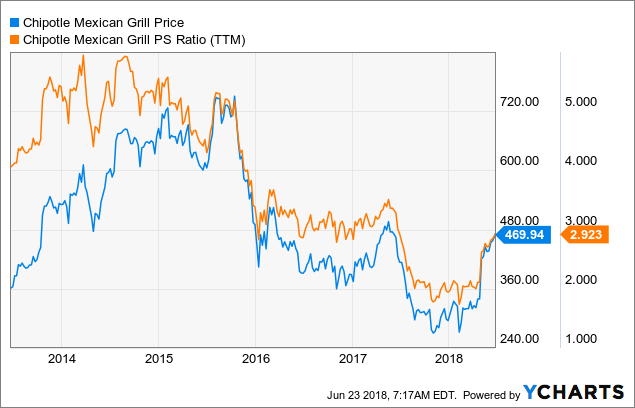

Chipotle has also seen its P/S ratio return to 2016 levels at around 3x. This is happening even as its sales (revenue) is back to its previous peak in 2015 on a trailing twelve-months basis.

CMG data by YCharts

CMG data by YCharts

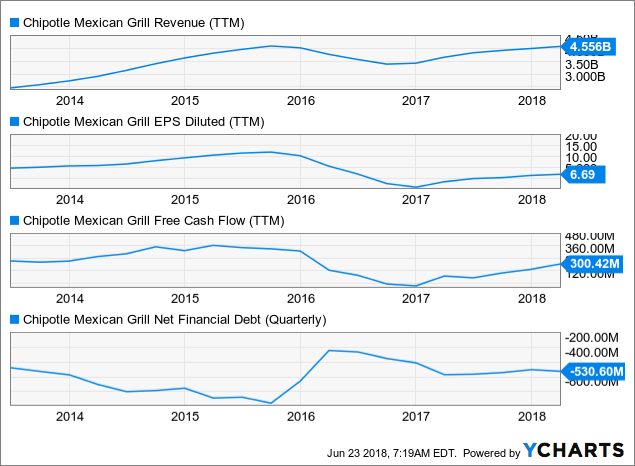

Its earnings and its free cash flow, however, would take some more time to see a recovery to the previous peak levels. Nonetheless, the positive momentum remains as Chipotle continues to build on the recovery after bottoming in early 2017. All the while, for much of 2017 and YTD, Chipotle has managed to maintain a net cash position of around $530 million.

CMG Revenue (TTM) data by YCharts

CMG Revenue (TTM) data by YCharts

Investor Takeaway

Some analysts have taken notice of Chipotle's turnaround and begun to raise their price targets. For instance, BTIG's Peter Saleh has upgraded this month his $460 price target to $500. A near-term catalyst would be Chipotle's strategy call set for June 27. Investors are eager to hear from the newly appointed CEO, Brian Niccol, on his initiatives to rejuvenate sales and profitability.

Already, the new CEO has made certain bold moves. Chipotle announced it would shift its headquarters to Southern California, where its new CEO lives, from Denver, Colorado, where Chipotle founder Steve Ells opened the first restaurant in 1993. The Orange County Register observed that Newport Beach, where Chipotle is heading to, is already "a quick service hub for the whole world". While the shift might be wise from a strategic point of view, such as the greater availability of talent pool, there are costs involved from the shift, as well as higher expenses due to the higher cost of living in California versus Colorado. According to Sperling's Best Places, an equivalent salary of $50,000 in Denver, Colorado, would be fetching a near triple at $139,059 in Newport Beach, California.

Nevertheless, market players have apparently gotten past the stage where they would be spooked by another health scare or dubious operating metrics such as the earlier mentioned "Facebook check-ins" and "online reviews" trends tracked by certain analysts. Investors are now willing to stomach the volatility to ride the recovery in Chipotle under CEO Brian Niccol's lead.

Deliveries have helped alleviate the long queues issues at the outlets. Chipotle announced in early May that it has experienced a 667% increase in weekly delivery orders since initiating the partnership with DoorDash, an on-demand restaurant delivery service. Restaurant industry insights and analytics firm TDn2K said recently that 'on-the-go' has "become an extremely important component of restaurant demand".

Chipotle is now in a similar situation as a year ago when it was also hitting fresh 52-week highs. Would this time be different? I cannot be sure, but its outlook is certainly more promising now than a year ago.

What's your take? Do you think there is more upside to Chipotle? Please freely share your thoughts, let me know if you found this article useful or provide your feedback in the comments section.

Author's Note: Thank you for reading. If you would like a refreshing take on stocks that you own or are interested in, try looking here. Besides US companies, I cover a number of Asian stocks as well. If you wish to be informed of my new ideas on Seeking Alpha via email so that you have time to read them before the articles get locked behind a paywall 10 days from publication, please select "Receive email alerts" when accessing on a desktop computer.

Disclosure: I am/we are long CMG.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Destination Wealth Management purchased a new stake in Fresenius Medical Care AG & Co. (NYSE:FMS) during the 2nd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm purchased 3,146 shares of the company’s stock, valued at approximately $158,000.

Destination Wealth Management purchased a new stake in Fresenius Medical Care AG & Co. (NYSE:FMS) during the 2nd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm purchased 3,146 shares of the company’s stock, valued at approximately $158,000.

24/7 Wall St.

24/7 Wall St.

Bytecoin (CURRENCY:BCN) traded down 6.2% against the US dollar during the 24 hour period ending at 13:00 PM Eastern on July 9th. Bytecoin has a total market capitalization of $550.44 million and $7.57 million worth of Bytecoin was traded on exchanges in the last day. One Bytecoin coin can currently be bought for approximately $0.0030 or 0.00000045 BTC on major cryptocurrency exchanges including Stocks.Exchange, Binance, Poloniex and cfinex. In the last seven days, Bytecoin has traded 14.3% lower against the US dollar.

Bytecoin (CURRENCY:BCN) traded down 6.2% against the US dollar during the 24 hour period ending at 13:00 PM Eastern on July 9th. Bytecoin has a total market capitalization of $550.44 million and $7.57 million worth of Bytecoin was traded on exchanges in the last day. One Bytecoin coin can currently be bought for approximately $0.0030 or 0.00000045 BTC on major cryptocurrency exchanges including Stocks.Exchange, Binance, Poloniex and cfinex. In the last seven days, Bytecoin has traded 14.3% lower against the US dollar.

CMG data by YCharts

CMG data by YCharts

CMG data by YCharts

CMG data by YCharts CMG data by YCharts

CMG data by YCharts CMG Revenue (TTM) data by YCharts

CMG Revenue (TTM) data by YCharts

Tredje AP fonden lifted its stake in Michaels Companies (NASDAQ:MIK) by 68.1% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 34,680 shares of the specialty retailer’s stock after acquiring an additional 14,050 shares during the period. Tredje AP fonden’s holdings in Michaels Companies were worth $2,153,000 as of its most recent filing with the Securities and Exchange Commission.

Tredje AP fonden lifted its stake in Michaels Companies (NASDAQ:MIK) by 68.1% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 34,680 shares of the specialty retailer’s stock after acquiring an additional 14,050 shares during the period. Tredje AP fonden’s holdings in Michaels Companies were worth $2,153,000 as of its most recent filing with the Securities and Exchange Commission.  American Century Companies Inc. raised its holdings in shares of AAR Corp (NYSE:AIR) by 6.6% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 252,492 shares of the aerospace company’s stock after purchasing an additional 15,568 shares during the quarter. American Century Companies Inc. owned 0.73% of AAR worth $11,137,000 as of its most recent SEC filing.

American Century Companies Inc. raised its holdings in shares of AAR Corp (NYSE:AIR) by 6.6% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 252,492 shares of the aerospace company’s stock after purchasing an additional 15,568 shares during the quarter. American Century Companies Inc. owned 0.73% of AAR worth $11,137,000 as of its most recent SEC filing.  Sumitomo Mitsui Trust Holdings Inc. trimmed its stake in SPDR Dow Jones Industrial Average ETF Trust (NYSEARCA:DIA) by 60.0% in the first quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 8,000 shares of the exchange traded fund’s stock after selling 12,000 shares during the period. Sumitomo Mitsui Trust Holdings Inc.’s holdings in SPDR Dow Jones Industrial Average ETF Trust were worth $1,931,000 at the end of the most recent reporting period.

Sumitomo Mitsui Trust Holdings Inc. trimmed its stake in SPDR Dow Jones Industrial Average ETF Trust (NYSEARCA:DIA) by 60.0% in the first quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 8,000 shares of the exchange traded fund’s stock after selling 12,000 shares during the period. Sumitomo Mitsui Trust Holdings Inc.’s holdings in SPDR Dow Jones Industrial Average ETF Trust were worth $1,931,000 at the end of the most recent reporting period.  SG Americas Securities LLC decreased its position in First American Co. (NYSE:FAF) by 68.1% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 28,415 shares of the insurance provider’s stock after selling 60,581 shares during the quarter. SG Americas Securities LLC’s holdings in First American were worth $1,667,000 at the end of the most recent quarter.

SG Americas Securities LLC decreased its position in First American Co. (NYSE:FAF) by 68.1% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 28,415 shares of the insurance provider’s stock after selling 60,581 shares during the quarter. SG Americas Securities LLC’s holdings in First American were worth $1,667,000 at the end of the most recent quarter.